How to Apply For r20 000 loan Boodle Loans in South Africa

Boodle loans are a popular way to raise capital for those who are interested in owning a Boodle. Boodle breeding businesses are on the rise and many people are now interested in owning one. There are many reasons why people are now interested in owning a Boodle. Many people are drawn by the cute appearance of the miniature dog. Boodle dogs are known as being highly sociable, intelligent, and easy to train. Owning a Boodle can also give you the satisfaction of owning a breed of dog that is well known and trusted for its ability to fetch.

Before looking for Boodle loans, you should research the credit provider that you will be working with. Some lenders specialize in providing loans only to people living in specific countries, while others do not. You should check your local credit provider to see if they are willing to provide Boodle loans for people in south Africans. Most credit providers in the UK will not work with borrowers who do not reside in the UK. However, there are some who will accept borrowers from outside the UK and even outside the UK if the applicant has sufficient proof of identity.

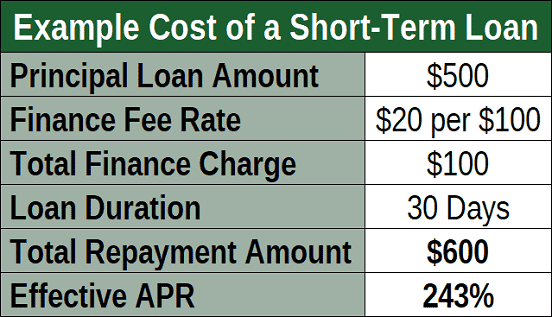

Once you have researched the credit provider that you will be working with, you should look at the different Boodle loans options that are available. Some loans are provided with high interest rates, but there are some lenders who provide reasonable interest rates. The amount of the loan that you r20 000 loan will be paying back depends on your credit history, employment and income level. The repayment schedule will also vary depending on the type of Boodle loan that you have applied for. Some loans may require that you make repayments every month, while others allow you to make smaller repayments regularly.

Once you have selected the appropriate Boodle loan, the next step is to gather all of the required documents before you apply. These include your credit checks, registration papers, the loan amount that you have chosen to borrow and the repayment terms and conditions. It is advisable to compare different Boodle loans to ensure that you choose a loan that best suits your requirements. Once you have all of these documents, you can now begin applying for your Boodle loans.

When you apply for your Boodle loans, it is important to understand the application process fully. If you are planning to apply for a small amount of money such as a loan for a few hundred pounds, you will be able to get approved very quickly. The process involves submitting an application form as well as one or two supporting credit checks. The application process is often quick and easy, especially since boodle breeding is currently becoming quite popular all over the world. Even though the application process can take a bit longer and is more complicated when it comes to large amounts of money, most lenders are willing to lend you up to a certain amount, which is usually around a thousand pounds or more.

For larger amounts of money such as ten thousand pounds or more, the loan application process will probably take a bit longer. Most lenders in south Africa do not lend large sums of money at the present time. However, most of them are willing to lend some loans if you can provide some evidence of your past success breeding your boodle. Most lenders in south Africa prefer to loans to dogs originating from countries that are renowned for producing good quality dogs such as Great Danes, Labrador dogs or Portuguese water dogs.

If you cannot prove your past credit history in south Africa, you may need to consider other countries and breeds that do not require credit checks. However, this does not mean that you should not consider borrowing money from any credit provider in the country. You may even be able to borrow money from non-credit providers. Regardless of whether you need to borrow money from a credit provider or not, it is better to borrow from a company in south Africa that has a good reputation in the business.

The loan procedures are usually very simple and they do not differ much between other countries and credit providers. It is important to remember though that you should not pay the loan back once you receive the funds. This is because your credit provider might be willing to lend you more money in the future when your business becomes successful enough. If you do borrow money from a credit provider in south Africa, ensure that you repay the loan on time so that you will not lose any opportunity to profit from the loans.